Support and Resistance levels serve as the backbone of technical analysis, offering an approach that is conceptually intuitive yet challenging to master effectively. These concepts act as the linchpin within a multitude of trading strategies, enabling traders to decipher potential turning points and make informed decisions based on the historical price reaction at these levels. They are crucial in interpreting Forex and numerous financial markets, providing a foundational framework that shapes the functionalities of multiple indicators and trading bots within the trading realm.

Foundational Concepts

- Support Level. Support Level represents a price floor where assets often garner upward momentum, impelled by a concentration of bullish buyers, preventing further price degradation.

- Resistance Level. In contrast, Resistance Level acts as a ceiling, a point where bearish sellers outweigh buyers, propelling a possible downward shift in price.

Analytical Nuances and Price Probability

The inherent uncertainty of market behaviors necessitates the use of terms like ‘often’ and ‘may’ since the interaction of prices with these levels doesn’t guarantee absolute reversals or continuations. The permeation of prices through these levels depends on the robustness of each, leading to potential rebounds or breakthroughs.

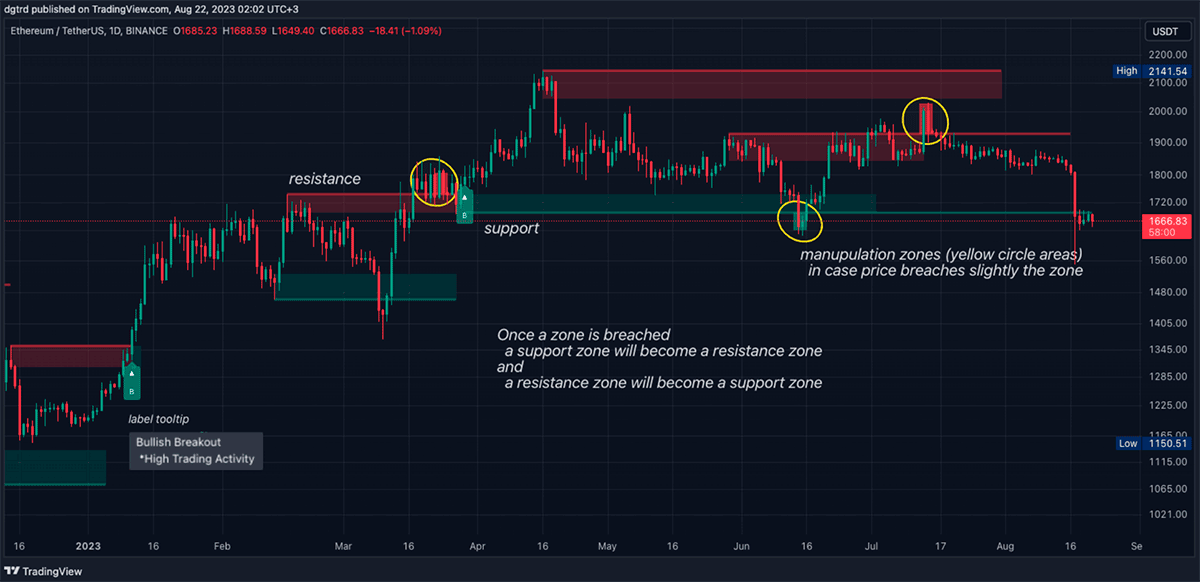

Understanding Zones versus Levels

It’s essential to conceptualize support and resistance as fluctuating zones rather than fixed levels, allowing traders to encompass the variability in price actions. For instance, assets like the EUR/USD pair exhibit zones around the 1.1500 mark, providing a more flexible understanding of market dynamics. The breadth of these zones is interwoven with the asset’s nature, the selected timeframe, and the overarching market volatility.

Real-world Practicalities

Currency Pairs:

- EUR/USD Pair: The zone usually spans between 20-50 points on a daily chart (D1).

- GBP/USD Pair: Its intrinsic volatility can create zones extending around 30-60 points.

- USD/JPY Pair: Distinct monetary policies post-2021 amplify zones to reflect the heightened volatility.

Time Frames:

- Daily Charts (D1): Zones display variability between 20 to 60 points.

- Hourly Charts (H1): The zones exhibit a narrower scope, ranging from 10 to 30 points.

Market Volatility:

Periods of heightened volatility, often catalyzed by significant economic developments, can expand the width of the zones. These alterations necessitate agile recalibrations of trading strategies to align with the evolving market landscapes.

Discerning Levels and Zones

Unveiling these pivotal levels involves analyzing psychological thresholds, areas with substantial trading volumes, and points of historical significance. Consistency in withstanding price movements renders levels more reliable, serving as formidable barriers against future price oscillations.

Integrative Tools and Indicators

- Moving Averages (MA): They illuminate trends and serve as dynamic support or resistance zones.

- Fibonacci Retracement: It unveils potential support and resistance areas by incorporating the Fibonacci sequence.

- Pivot Points (PP): They employ averages of different price values to unearth pivotal levels.

- Bollinger Bands: These bands comprise a middle MA line and two standard deviation lines, indicating potential support and resistance regions.

Refining Strategies and Tactical Adaptations

Astute application of support and resistance insights can elevate trading strategies like "Breakout/Breakdown Trading," "Bounce Trading," and "False Breakout Strategy," fostering enriched trading acumen and efficiency.

Conclusive Insights

A deep-rooted understanding of support and resistance, blended with meticulous strategy implementation and harmonization with diverse analytical tools, constitutes a profitable trading arsenal. However, the inherent unpredictability in financial markets mandates a balanced integration of theoretical insights, rigorous analysis, and sagacious risk management, equipping traders to navigate through market ambiguities with enhanced precision and resilience.

In the pursuit of market mastery, the synergy of foundational knowledge and refined practical skills enables traders to traverse the intricate tapestry of financial landscapes, transforming market uncertainties into opportunities for strategic trading triumphs. The strategic deployment of these levels, infused with other analytical methodologies, is indispensable for traders aspiring to transform market turbulence into avenues of strategic success.

In today’s fast-paced financial world, responsible trading is no longer a choice; it's a necessity. Technology has opened the markets to everyone, making access incredibly easy.

In today’s fast-paced financial world, responsible trading is no longer a choice; it's a necessity. Technology has opened the markets to everyone, making access incredibly easy. For active traders and investors, mastering the art of trading volatility is a crucial skill. Volatility, in financial terms, refers to the extent to which asset prices fluctuate over time. High volatility markets experience rapid price swings...

For active traders and investors, mastering the art of trading volatility is a crucial skill. Volatility, in financial terms, refers to the extent to which asset prices fluctuate over time. High volatility markets experience rapid price swings... The global financial market operates as a dynamic ecosystem, where understanding the connections between different market movements can provide invaluable insights for forecasting...

The global financial market operates as a dynamic ecosystem, where understanding the connections between different market movements can provide invaluable insights for forecasting... The forex market, also known as the foreign exchange market, stands as the largest and most traded financial market globally. FXTM is committed to equipping our clients...

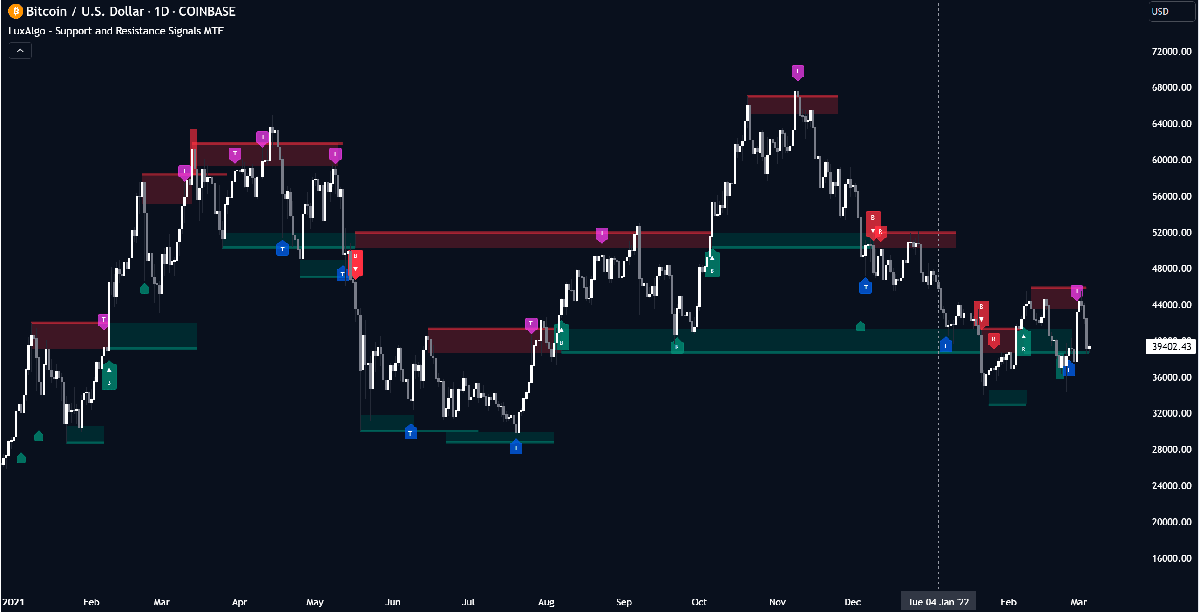

The forex market, also known as the foreign exchange market, stands as the largest and most traded financial market globally. FXTM is committed to equipping our clients... Cryptocurrency trading has rapidly grown into a bustling and dynamic market that attracts traders from around the world. With the potential for significant profits...

Cryptocurrency trading has rapidly grown into a bustling and dynamic market that attracts traders from around the world. With the potential for significant profits...