The day ahead promises to be a battleground of financial dynamics. The latest Consumer Price Index (CPI) release in the US provided a slightly hotter reading than anticipated, yet it failed to sway expectations regarding the Federal Open Market Committee (FOMC) raising interest rates at its upcoming meeting next Wednesday. The prevailing sentiment still suggests that the odds for a tightening move in November remain no more than a 50-50 proposition.

Before the CPI data, Treasury yields were positioned to account for potential upside risks. Upon the release of the data, yields surged in response to the 0.6% increase in the headline figure and the 0.3% gain in the core CPI, resulting in year-over-year rates of 3.7% and 4.3%, respectively. However, yields rapidly receded, closing the session on a higher note due to short covering.

Meanwhile, in Asia, stock markets made modest gains, seemingly undeterred by stronger-than-expected US inflation figures. Investors were looking ahead to the European Central Bank (ECB) decision.

ECB Meeting and Rate Hike Expectations

Today, the ECB convenes for a crucial meeting, and there are reports suggesting that the updated staff projections will push the 2023 inflation forecast above 3%. This development has bolstered expectations of another 25 basis point hike in interest rates. While a hawkish pause would not be entirely surprising, there appears to be a slightly higher likelihood that the ECB may take action this week, especially given the expected upward revision to the inflation forecast and recent increases in energy prices.

In the realm of currency markets, the USD Index is trading around 104.60. EURUSD exhibited mixed performance but experienced a decline in the European session, slipping from 1.0754 to 1.0733. USDJPY managed to maintain levels above the 147.00 floor, with an eye on the 148 mark.

In stock markets, the JPN225 recorded a notable 1.4% gain, reaching 33,168.10. The US500 edged upward to 4534, while the US100 surged to its August ceiling. However, the US30 was unable to extend its climb beyond 35,000. In the US500, airline stocks faced significant losses, with United Airlines falling by 3.8% and Delta Air Lines by 2.8%. Conversely, Amazon saw a 2.6% increase, Microsoft gained 1.3%, and Nvidia rose by 1.4%. Moderna experienced a 3.2% rally after announcing promising results from a flu vaccine trial.

Commodity Outlook

The oil market remained robust as it focused on the potential for sustained supply tightness throughout the year. USOIL currently stands at $88.60, rebounding from lows around $87.60.

Today's agenda includes the ECB rate decision and press conference, as well as the release of US retail sales and Producer Price Index (PPI) data.

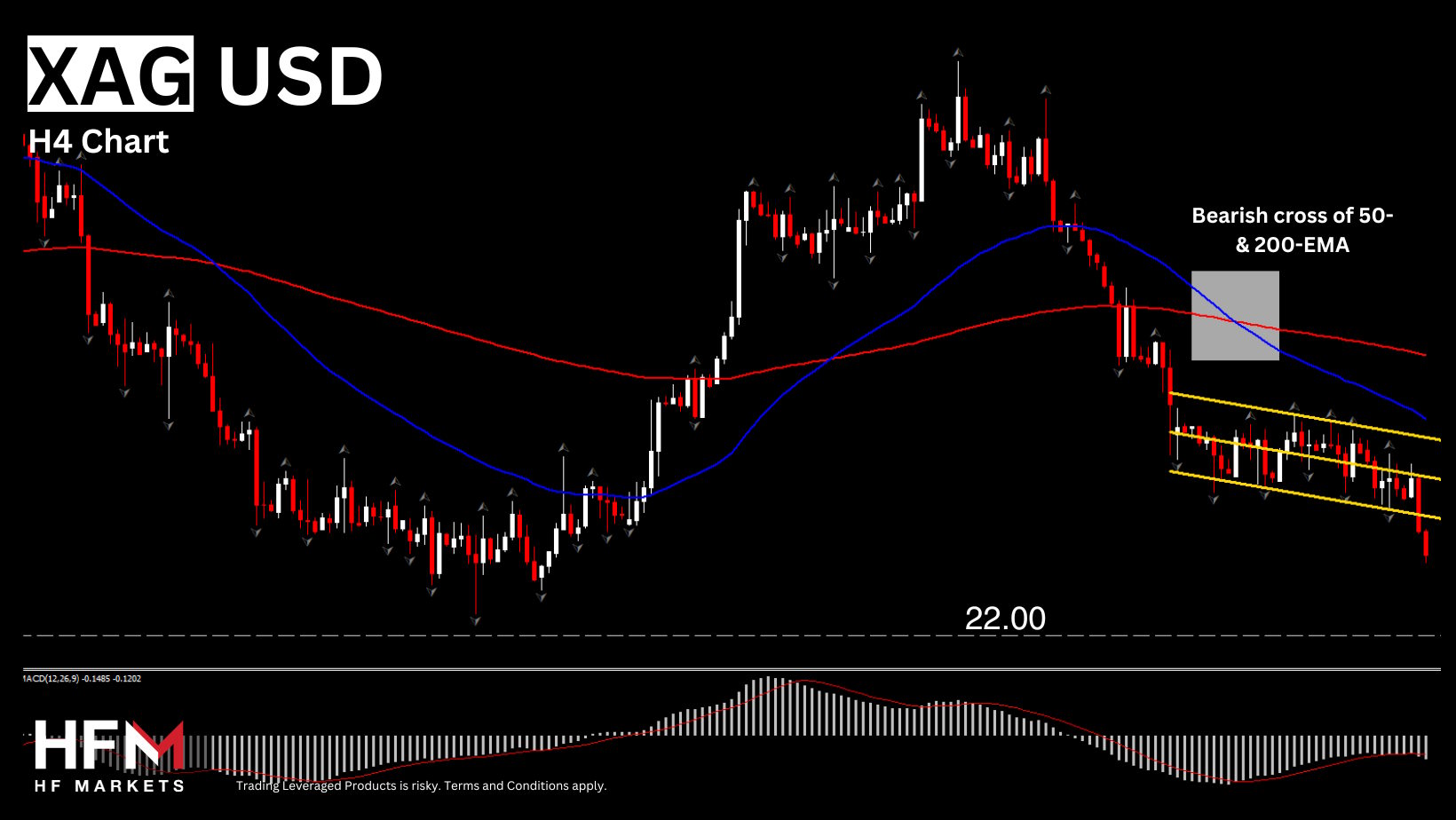

Notable Market Movement: Silver (XAGUSD)

Silver (XAGUSD) experienced a decline of 1.18%, breaking its five-day range. The downward trajectory in September appears to be extending, drawing attention to support levels around $22 and $21.

OnsaFX has been honored with the "Best Forex Partners Programme" award at Wiki Finance Expo Dubai 2025, one of the world’s leading financial and fintech events.

OnsaFX has been honored with the "Best Forex Partners Programme" award at Wiki Finance Expo Dubai 2025, one of the world’s leading financial and fintech events. FxPro, the leading online broker, is excited to announce the full launch of TradingView integration across its trading platforms, following a successful beta phase.

FxPro, the leading online broker, is excited to announce the full launch of TradingView integration across its trading platforms, following a successful beta phase.